16 COMPANIES WILL IPO SHARES IN THE FIRST SEMESTER OF 2018, HERE'S THE LIST

09 March 2018

Bareksa.com – The Indonesia Stock Exchange (IDX) has received registrations for 16 companies in the pipeline that will hold initial public offerings (IPOs) of shares this year. PT Wahana Vinyl Nusantara is the most recent company that has held a mini expose with the IDX.

Director of Transaction Supervision and Compliance of the Indonesia Stock Exchange, Hamdi Hassyarbaini, said Wahana Vinyl Nusantara is targeting funds of around IDR 1.5 trillion from the IPO. The company will use the December audit book to go public.

Wahana Duta Jaya is a PVC pipe manufacturer with the trademark Rucika Wavin. Hamdi said the company's shareholders are all domestic.

“Everyone who hears the brand, knows what kind of company it is. They control about 50 percent of the market,” he said in Jakarta, Friday, March 9, 2018.

According to Hamdi, quite a number of companies are interested in conducting IPOs in the first semester of 2018. This is because Indonesia's macroeconomic conditions are currently good.

In addition, it is also possible that the company chose to IPO in the first semester of 2018 because it anticipates the presidential election that will take place next year.

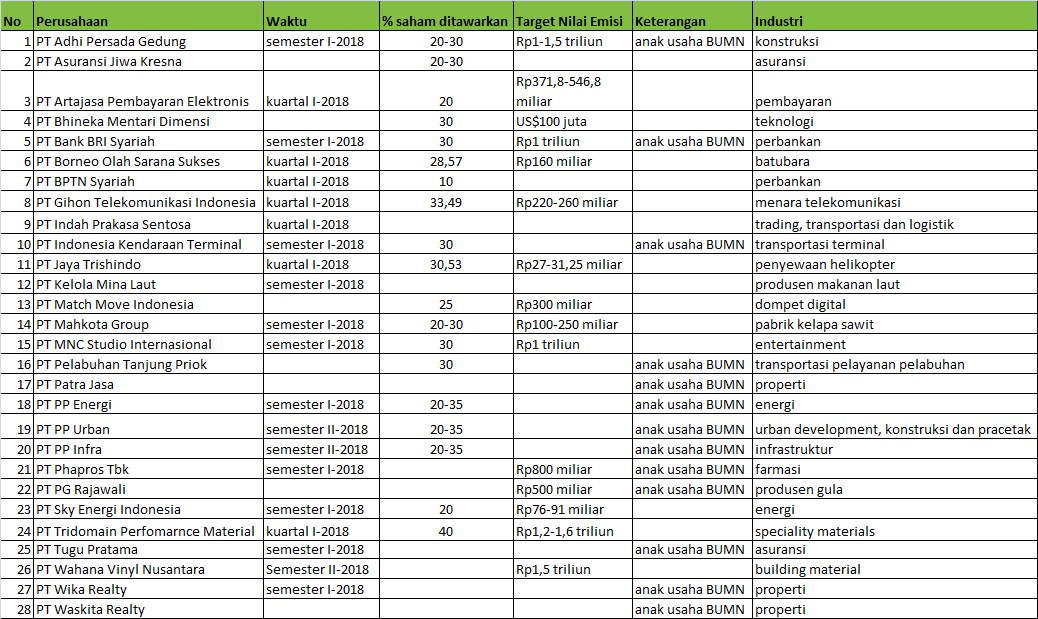

Of the 16 companies in the pipeline that will hold IPOs this year, three of them are subsidiaries of state-owned enterprises (SOEs). The three companies are PT Bank BRI Syariah, PT Tugu Pratama and PT Wijaya Karya Realty (Wika Realty).

Underwriter

President Director of Wahan Vinyl Nusantara, Steven Widjaja, said the company has appointed three securities companies as underwriters. The three companies are Citigroup Sekuritas Indonesia, RHB Sekuritas and Mandiri Sekuritas.

The company will issue a maximum of 20 percent of its paid-up capital to the public. Later, the proceeds from the IPO will be used for expansion, namely increasing the company's factory capacity.

According to Steven, Wahan Vinyl now has a production capacity of 200 thousand tons per year. The amount will be increased next year after the stock IPO.

The increase in production was carried out because the company saw the opportunity to have new partners. Currently, the company's potential new partners come from Japan and Europe. “We may also explore the export market, the funds are for all expansion,” he said.

List of companies that have and will hold IPO 2018