MEASURING THE TREND OF IPO STOCK MOVEMENT

14 December 2018

JAKARTA. The shares of newcomers to the stock exchange this year have become the market's attention. This is because the majority of their prices jumped on the first trading day in the secondary market. However, after about three months on the stock exchange, the price movement trend is now starting to take shape.

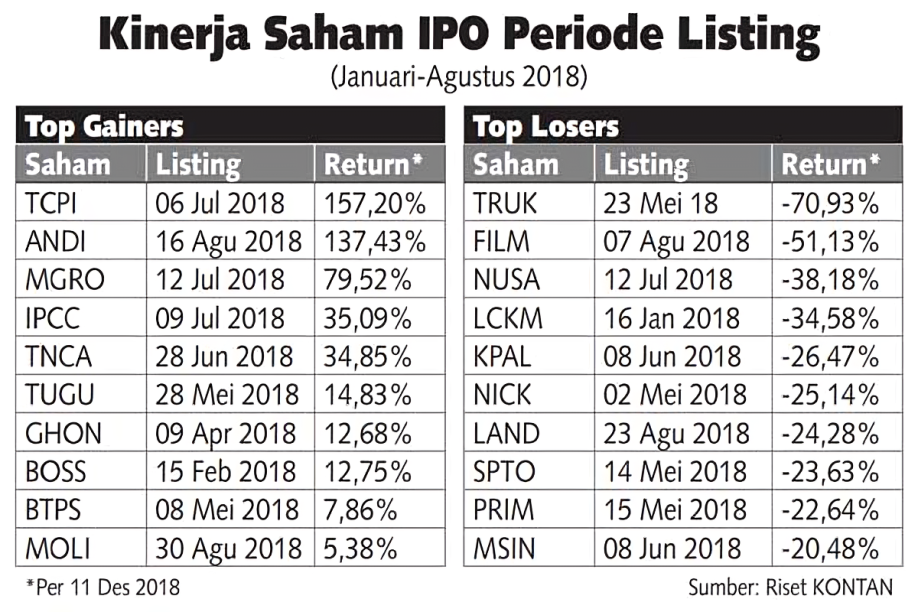

Of the 34 stocks listed in the January-August period, a number of stocks showed a positive trend. Top gainers include Transcoal Pacific (TCPI), Andira Agro (AGRO) and Mahkota Group (MGRO). Conversely, the top losers were Guna Timur Raya (TRUK), MD Pictures (FILM) and Sinergi Megah Internusa (NUSA) (see table).

Binaartha Sekuritas analyst M. Nafan Aji said, the movement of shares for three to six months after the IPO, is enough to illustrate the trend of price movements. Up or down the share price will follow the demand in the market.

Mino, an analyst at Indo Premier Sekuritas, believes that it is difficult to analyze the movement and investment feasibility of IPO shares if they have only been traded for less than three months. Sometimes even up to six months, investment feasibility is still difficult to see. The reason is that IPO share prices are often conditioned, aka fried.

Therefore, it is not unusual for the IPO share price to reverse after three months or six months. The price starts to reflect the actual condition. “Maybe it has not been in demand since the highest increase,” said William Hartanto, Panin Sekuritas analyst, Tuesday (11/12).

Therefore, if you want to invest in IPO stocks, investors should ideally learn about the performance and business prospects of the issuer. Investors can find this data by reading the prospectus.

Preferred stocks

According to Mino, among the IPO stocks this year, the most interesting one is BTPS. This is because next year, the banking sector is predicted to grow at least the same as this year.

Meanwhile, William recommended MSIN, MGRO and IPCC shares. He reasoned that the increase in the price of these stocks was not due to fried action. “The term is a healthy trend compared to others, fundamentals are still good,” he said.

For example, MGRO's future performance could be boosted by the biodiesel obligation (B20), which also has the potential to be increased to B30. Meanwhile, MSIN's prospects are quite good with content product innovation.

Meanwhile, IPCC has the opportunity to grow by adding a joint venture with Triputra. “TCPI is actually risky. It has risen high and is still suspended. Usually, if the suspension is long, when it is opened, many will sell,” added William.

Nafan assessed that investors can see the trend of price movements in the last three to six months. If it is bearish consolidation or sideways, it should be avoided. “What is quite good next year is banking stocks, CPO and coal,” he predicted.

Source : Harian Kontan, Rabu 12 Desember 2018