CHOOSE THOSE WITH LONG-TERM PROSPECTS

23 December 2018

JAKARTA, For Usli Sarsi, investing is not just about chasing profits in a short time. The President Director of PT Mahkota Group Tbk (MGRO) considers investment as a way to achieve financial freedom in the future.

That is why the instrument chosen must also be prospective in the long term. Usli's experience in investing is unlike many people.

The man born in 1971 started his investment by forming a company with his relatives. His business was engaged in the property business. At that time, he was still young, around 24 years old.

But he didn't start the property business without experience. After graduating from high school, the man from Tanjung Leidong, LabuhanBatu, North Sumatra, went straight to work for his family's contracting company. Because of this job, he chose to leave college.

Usli said, at that time, he was interested in running a property business because the development of development in Medan City, North Sumatra, was accelerating. “Property prices are also moving fast, the profits are quite large,” he said. Just so you know, at that time, from the company bonus, Usli was able to buy property in the form of a residential house.

Over time, he diversified his investment by buying oil palm plantations. He considered the palm oil business prospective.

However, Usli only managed the oil palm plantation for six years. He chose to sell the plantation, because in the following few years, the price of the plantation and oil palm rose significantly. “I even made a profit of up to 500% after selling”. He said.

Apart from real sector investments, Usli also tried instruments such as deposits, gold and shares of publicly listed companies. He also applies the same strategy when choosing stocks. She chooses stocks in the plantation, bank and property sectors. He believes that these three sectors have good future business prospects.

Moderate-aggressive type

Of all the investment instruments, the man who graduated from WR Supratman High School, Medan, prefers investment in oil palm. That is why, he even established a palm oil plantation and processing company, Mahkota Group, which he manages until today.

The reason is simple, Palm oil and its downstream businesses have tremendous potential in the future, both for industry and renewable energy.

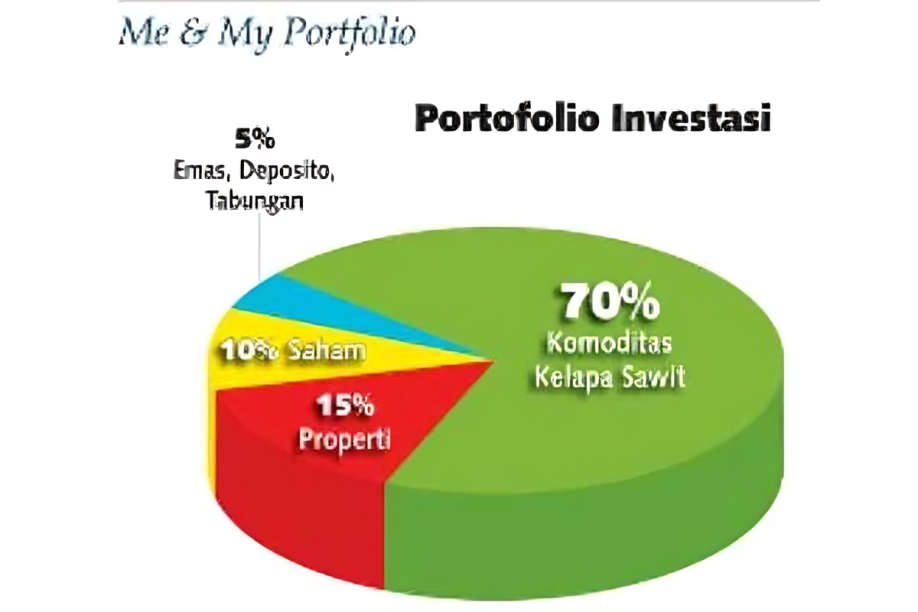

Currently, the majority of Usli's investment portfolio is in the form of real investment, in the form of oil palm plantations and processing. The portion reaches 70%. The rest is in the form of property, stocks, gold, deposits and savings.

Usli categorizes herself as a moderate, slightly aggressive investor. She will be moderate when the situation is normal. However, when he sees opportunities or economic indicators and business momentum that are moving in a good direction, he becomes a little aggressive.

Despite being more aggressive, it does not mean ignoring his two main principles in investing. “Remain a smart, observant and thorough investor. Invest in sectors that have great potential in the future,” says the father of two.

The next principle is that you should invest for the long term, rather than chasing a quick buck.

Having experienced the benefits of investing, Usli is keen to share her experience with her relatives and friends. Based on her experience, Usli said that novice investors should first recognize the type of instrument they want to buy.

Understand the characteristics of the instrument. “After that, you must have the courage to take steps. Don't speculate too much and be a long-term investor,” he said.

Source : Harian Kontan terbit 22 Desember 2018